Since today morning, I am seeing many people adjudging the disappointment for the salaried class as a massive binge. Also, I had someone on my facebook writing that Salaried Classes deserve to be taxed, himself a blogger and son of a businessman. He had his points of trouble too, which I do not ignore. However, the fact remains that 1.76% of Indians pay income tax remains a sore point.

Let’s get some facts straightened out.

- Only 1.76% of all Indians living in India pay direct tax (income tax) (NRI’s are not taxed either). However, 100% of Indians who can spend money are assumed to pay indirect tax. The key word is “assumed,” as there are no statistics to define tax evasion because it is only kept a secret from the government.

- Tax evasion (especially by businesses) still the bane of Indians themselves. Everyone wants to see what he or she can save from paying income tax, including avoiding paying tax in any form, at all.

- 52% of Working Population is classified as Farmers do not get taxed for their income (even though few make as much money to own many luxury cars!) (ref: 1, 2)

- There are no statistics on the number of beggars or homeless. However, they do pay Indirect Taxes as well.

The Pro Budget 2018 debates floating around

Middle Class benefit from lower home loan rates, lower consumer price index and fiscal deficit and income tax slab rates being appropriate. An article at OPIndia.com states:

“And while we are at it, as a bigger consumer of goods and services, middle class benefited most from the GST regime. Those struggling to make ends meet don’t care about restaurants and hotels. You pay 5% GST now, compared to a 18% Service Tax earlier on that dinner out. That rebate is entirely yours. “

GST on Restaurants

Well, not exactly true. The ground reality is that before GST, a large number restaurants did not charge taxes separately. The food menu was almost always inclusive of taxes. However, when GST was announced, almost all of the restaurants were charging GST over the top of their pre-GST rates. This was well published in leading newspapers based on citizen reports.

After GST was lowered for restaurants, the bill total remained the same and cost of food went up. This is called profiteering. And middle class do not have lunch and dinner at fancy hotels every day, Mr. or Ms. behind the pseudonym wrote the article.

Not the only ones paying taxes?

Stop deluding yourself with the notion that you are the only one paying taxes. Your 4.31 lakh crores in direct taxes is just 19% of the total 22.17 lakh crore tax revenues collected by the Govt.

The author seems to forget that the salaried middle class who gets his pay after deducting income tax also pays indirect taxes. The above statement is willfully excluding this fact. It of course is a matter of concern for salaried middle class, on the amount of indirect taxes one ends up paying. In fact, structure of GST is build around avoiding double-taxation for businesses. On similar lines, the salaried middle class should get a rebate on his income tax outlay based on the amount of GST she or he has paid. Only to be fair right? That is not the case, and hence it is a huge concern.

A salaried middle class person, having an total income worth Rs. 10 Lakhs, will end up paying an average of 11% income tax plus an average of 17% GST on his necessities. That is 27% taxes already! Without even counting the GST on Investments, expenditure on holiday, travel, restaurants and the biggest of them all, taxes on Fuel!

What an non-tax paying citizen pays? Minus the 11%, everything else if she or he is being honest. So why should the salaried class continue to bear 11% additional responsibility for returns that everyone enjoys? For development of the country, of course!

The Farmers

Firstly, go and delete those posts you shared on social media lamenting about poor farmers, because you didn’t mean them. Everyone wants poor to be helped, farmer to be saved – but it should be paid for by someone else. Well, there is no ‘someone else’ out there, it has to be ‘us’.

The article assumes that we do not care for farmers. Heck, the author even has the audacity to declare our intent and actions in no less words than being mean, and accuses everyone of the social media shares and posts that we made in support of farmers because “you didn’t mean them”. Absolute trochaic, in line with all the so called Bhakts out there.

The skewed Taxation structure

The article assumes that Salaried Middle Class income tax payers expect that someone else should bear the expenses for the farmers to be saved. However the author ignores how diverse strategy our country and each state’s tax collection have. Here is a video that helps explain how farmers get or do not get compensation, a brilliant study by Praveen Chakravarty with BloombergQuint.

With such a complex tax collection situation, people living in the four states namely Gujarat, Maharashtra, Karnataka and Tamil Nadu, essentially are supporting the whole country with more than 50% of the tax revenue collection share. They are already getting way less than what they contribute for, not only in terms of direct taxes, but indirect as well.

Let us not forget the skewed national policy on fuel pricing, which is not under the ambit of GST yet, and may not appear to fall under it in near future. For sure, State Governments benefit from this situation, however, the common man still pays for them.

Corporate Tax Rates

And stop grudging the industry and corporates. There would be no middle class without industry and corporates. You would be poor class in no time, if industry died. So it already indirectly benefits YOU.

It is an universal phenomenon that Corporates should be treated well for they create jobs, and benefit the society. In fact, I have not come across many middle class individuals who complained of it either. The complaint is mainly with regards to tax evasion. If tax evasion is plugged, the this country does not require 1.76% of Indians to pay Income Tax! That is a reality, and let us not forget it.

India is among the largest countries in the world and have a population to feed. For how long can this 1.76% of Indians continue to pay income tax for the rest of the country? The income tax base has to increase for both salaried and business, and once we are collecting more than enough money reduce the tax rates. Salaried Middle Class is worried the budget did not focus on anything that remotely suggests government is doing to catch hold of tax evaders.

Comparisons to previous governments

Middle class has a serious Ghajini disorder! We forget the days of 10-14% inflation under UPA-2 or even when Toor daal prices being at above Rs 200/- in 2015 were a matter of middle class outrage.

How does a comparison helps? Calling middle class Ghajini is an insult, when the author itself forgot other aspects leading to inflationary costs?

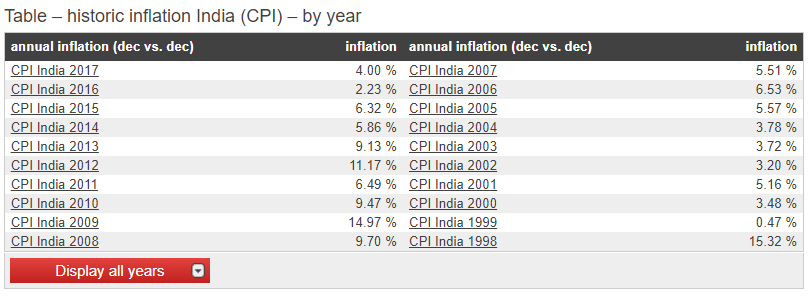

Inflation rates were high and low during UPA government, true. However, the inflation was on its downward spiral already when the new NDA government took over already. Take a look at this graph from a global reputed website managing inflation numbers for many countries.

NDA government did not had to battle global cues. Like spiraling crude oil prices and international financial conditions that kept UPA-2 on their toes. They still managed to keep the prices of petrol and diesel to the limits. The fuel prices ensured that inflation did not exceed limits that living for a common man became difficult.

I am not advocating UPA or Congress, however they did have issues at their hand, out of their control to manage. The fiscal deficit was not under control for the same reasons. Because the government had to keep up the subsidy rates for a lot of essential products, including agricultural fertilizers.

Other “WhatsApp forward” arguments

Lower Home Loan lending rates

My home loan interest rate at the end of 2013 was between 9.5 to 11.25%. It has come down to under 8.5% now. (Keeping SBI as Reference) Even a difference of 2% Rate in a loan of 30 lakhs gives you savings of 45000 Annually, as per SBI Home loan calculator. Is that not for middle class?

The argument that lower home loan interest rates is saving the salaried middle class up to Rs. 40,000 a year is a farce!

Home loan rates are less for sure, but that does not itself qualify as a middle class focused. It even helps the rich and poor. Moreover, yes, those who are not paying home loans are higher in numbers – and therefore, absolute lack of any benefit for everyone.

Plus, many other factors influence home loan rates than just because the government wants to reduce it. Also, why are different types of loan rates expensive when the prime lending rates are same for the banks, after all, aren’t they?

REPO Rates

Inflation impacts Home Loan rates, itself based on REPO Rate set by RBI. Wholesale and Retail Price Index, Current Account Deficit, International Gold and Oil prices, etc. are other factors.

Some of the factors usually considered by the central bank are;

- The central bank monitors the trajectory of inflation before deciding on the REPO rate, to maintain economic harmony

- They study and predict the future inflationary pressure to create a REPO rate to control the economy

- Fiscal deficit rate promised by the union government in their budget plan.

With a higher Path of Inflation, Wholesale and Retail Price Index and Weaker Oil Prices but higher domestic pricing, it is easy to see why RBI decided to lower the REPO rate.

Remember, majority of the benefit in loan rates we see today is in no small part, thanks to Raghuram Rajan whom Modi Govt. did not see fit to be part of RBI and went against them!

The lower Consumer Price Index or CPI.

Average Consumer Price Index (CPI) was 10.92% in 2013 while it is 2.49% right now. JUST IMAGINE, what would have been the prices of the goods of common usage if such a high CPI rate was still there

The inflation rate is based upon the consumer price index (CPI). And it is not appropriate reflective figure of what the typical Indian faces in reality. CPI does not necessarily translate end-user impact is. From 14.9% in 2009, even the Congress government had managed to bring it down to 5.86% in 2014. But did you see the impact on the ground? The point I am trying to make is – you cannot adjudge impact on you individually using these rates.

Every time petrol prices have gone up, the majority of vegetables and other commodities that are necessity become pricer. With a favorable change in petrol prices, the rates never went down. Ask ourselves, what was the cost of vegetables four years ago and how much they are costly now? Consistent with what happened during previous governments, including the ones ruled by Congress. Cons of any party in power are too significant not to have an impact on the actual aam aadmi.

Lower fiscal deficit invites investments

Fiscal Deficit was 4.1% in 2013 while it has been targeted to be 3.3% for 2018 (Through this budget only). If we don’t reign in the fiscal deficit, it will lead to manipulation of capital structures, interest rates, will lead to decrease of net exports and will result in even higher taxes and higher inflation. So, dear friends, the budget is also aimed at keeping the inflation in check (Such are the strange ways of Economics)

Fiscal deficit is one thing that we can think of where Govt. has been focusing right. However the focus has not brought in the expected impact on the ground. In spite of global cues like crude oil trading low and positive from FD point of view. There is more unemployment today than investments India is attracting. For the sake of argument, why would the government dole out a budget that impacts or delays the reduction of the Fiscal Deficit? It is absolutely counter productive to appraise this budget on this point alone.

Because this is an election budget, as with every govt., they are selfish to ensure they win the next one! The Agriculture push in this budget only came after BJP nearly lost out on their plot on the development to the plight of the farmers in Gujarat! Who paid attention to the farmers protest in Delhi this year long? No one, because by then BJP had successfully ignited the Karni Sena-Padmavati uproar.

Fuel Prices

It is difficult to know where all this money went. However, unlike Jaitley said in the press conference, the increased tax has not led to better roads in places where we have lived or traveled. One notable exception is highways; however, I use our city roads more often than highways.

Global cues influence increase in fuel prices. However, when the barrel costs were down, the Govt. refused to pass on the benefit to consumers. No, it does not only impact ones who own a car or bike. It is the transport sector which uses diesel to transport goods that you and I buy. Petroleum product prices are directly proportionate to incrementing inflation. However not so much to in case of a decrease in inflation!

Tax Slab Rates

Big decisions like these can never be viewed in Silo. We also need to find out a pattern and if there is any rationale behind it. Most of us were expecting at least a tax slab raise to INR 3 lakh per annum from INR 2.5 Lakh per annum which means a saving of INR 2500 per annum as it in any case fetches a tax of 5% only to the Government or INR 208 per month.

I was not expecting an increase of mere Rs 50,000. I was excepting a whole lot more. Jaitley said from before elections, that Income Tax should be exempt for up to Rs. 5 lakhs. And it is a relief as compared to just 50,000! Also, all of us irrespective of our income tax accountability end up paying indirect taxes at everything that we buy. So what is the point of taxing personal income then? Majority of the new taxpayers in the economy are in that bracket. It helps these new employees save more money or spend it!

The jibe Jaitely gave out during his budget speech about Income Tax from Salaried individuals was more than people in business, do you think it is right? I mean, sure Salaried get their share of taxes cut even before their salary is credited every month. Businessmen evade taxes!

The government decided to Demonetize this economy in the hope of curbing tax evasion! And if even you do not admit it, you know that it was an actual failure on the ground. It did help in a marginal increase in tax paying business; however, that did not help you and me, did it?

It is easy to get carried away by propaganda, much difficult to sort out the differences. So look at ground realities and stop dreaming of an India that does not exist today. Live the reality. Please.

Peace.

India

India

I do not agree with your calculations, though through the motives. It simply pains as a tax payer to continue paying taxes while others do not.