You are paying 200% tax on the petrol or diesel that you are buying. Believe it or not, it is actually true. 200% is indeed too much to think, but an Indian today buying fuel is paying this much amount of tax. This includes both for and against this government.

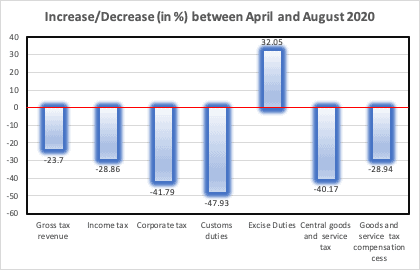

The only tax that grew, year on year!

India has famously avoided getting Petrol/Diesel as part of GST. Both Centre and States are responsible for it as they see it as a cash-cow that they can milk to the most. In a quasi-federal state set up that India has, the GST was always an exception.

Source: Centre for Monitoring Indian Economy.

Excise Duty is the only tax revenue that grew as compared to 2019 – which should be surprising given every other tax revenue has fallen due to the lock-down measures. But it is not. Because we know that Govt has been raising the taxes and cess on Petroleum fuels constantly.

Deregulated Petrol Prices, an eyewash?

Normally, the price of fuel after deregulation was linked to the Crude Oil prices. That has changed in the current regime. When the global prices started hitting the low, the Govt. instead of reducing the price, increased the taxes.

They did what the Chinese do – take two steps forward, and take one step back. The excise duty on petrol was increased by ₹3 per litre in March. In the month of May, they again raised by ₹10 per litre. So much so that, today it stands at ₹32.98 per litre.

Costliest Petrol in Asia?

Petrol that you buy in Delhi ₹81.12 per Litre today is among the highest you pay for petrol in India. In Islamabad (PK), the price for a litre of petrol is ₹46.29, in Colombo (SL) it is ₹54.86, and in Kathmandu (NP) it is at ₹66.52.

Nepal buys petrol from India, at half the cost you and me pay for a litre. That in itself is a clear indication of how unfair the prices are taxed. Even importing a car attracts only 60% to 100% duty, but you and me pay more than 200% taxes on Petrol.

With COVID19, consumption sure has taken a hit given a lot of users are now working from home in the urban areas, while consumption of diesel has more or less is back to pre-Covid levels. The difference is marginal and indeed the govt of India is making a lot of money from the petrol taxes.

The only hope is – it all be used for the right purposes.

India

India